SEC Investigation Updates: October 08, 2025

Five Companies: AGIO, ANET, ARR, DBD, ESLT

Agios Pharmaceuticals, Inc. - AGIO ($40.87 $2.4 B mkt cap)

Arista Networks, Inc. - ANET ($145.29 $182 B mkt cap)

Armour Residential REIT, Inc. - ARR ($15.59 $1.8 B mkt cap)

Diebold Nixdorf, Inc. - DBD ($57.33 $2.1 B mkt cap)

Elbit Systems Ltd. - ESLT ($520.50 $23.6 mkt cap)

Agios Pharmaceuticals, Inc. – AGIO

Removed from Watch List

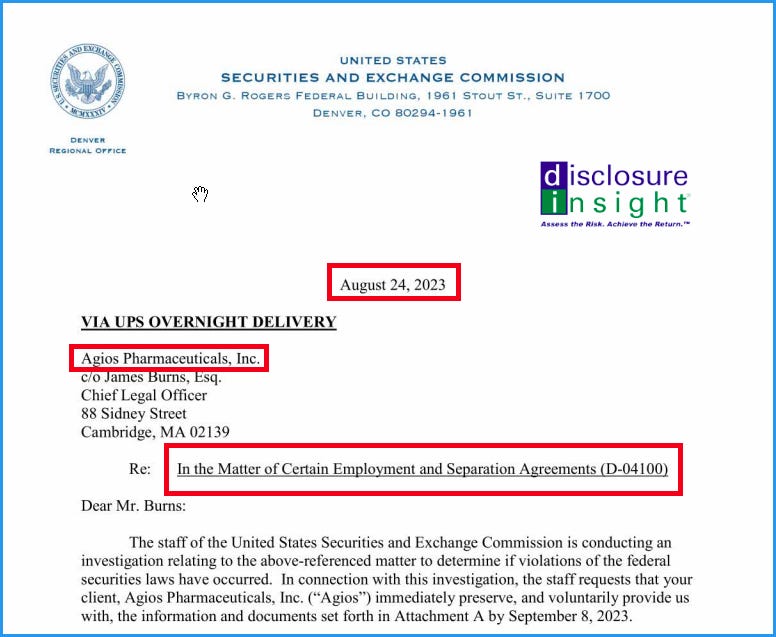

Undisclosed SEC investigation ends, we have some of the records. This investigation was titled, “In the Matter of Certain Employment and Separation Agreements.”

Document excerpt here -

You don’t want to see one of these investigations at a company. It tells us there was an SEC probe into possible violations of a rule where a company may have used employment or consulting agreements — or releases — to discourage individuals from communicating directly with the SEC about potential securities law violations.

The timing of this investigation is notable, if not troubling. It began in Aug-2023 and concluded in Mar-2025. That start date came just after the Audit Committee Chair declined to stand for reelection in Apr-2023. Another Audit Committee member also departed abruptly, effective May-2023.

Makes you wonder: were one or both of those Audit Committee members the SEC’s tipsters?

Arista Networks, Inc. – ANET

Removed from Watch List

Undisclosed SEC investigation ends. On 24-Sep-2025, we learned an undisclosed SEC investigation we first found at Arista Networks on 27-Aug-2024, appeared to be over. The investigative file was remanded for further processing. In the history we earlier noted the abrupt departure of the general counsel, effective 07-May-2025, with no explanation given.

Armour Residential REIT, Inc. – ARR

Removed from Watch List

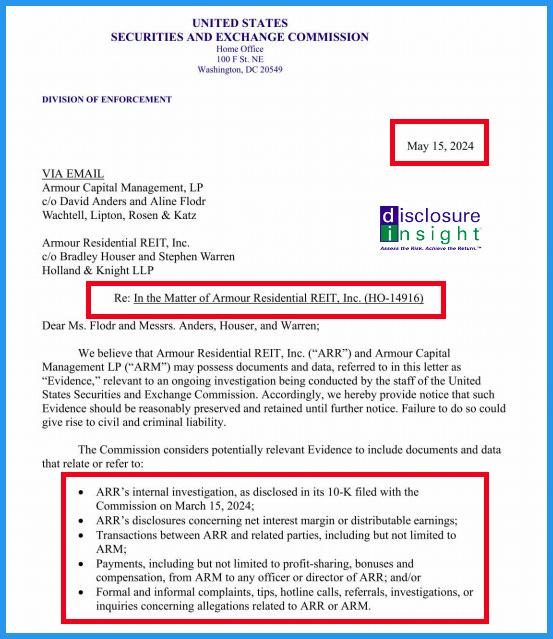

Undisclosed SEC investigation ends, we have some of the records. Primarily focused on Armour’s relationship with Armour Capital Management, the documents we obtained are from May-2024 to Jul-2025. An excerpt is cited below.

We previously found a wide array of accounting-related problems here, including an internal investigation that lasted less than a month in 2024 (it was part of the SEC’s investigation); controls problems; 10-K delayed in Mar-2024; CFO transition; and retirement of co-CEO.

Document excerpt here -

Diebold Nixdorf, Inc. – DBD

Removed from Watch List

Undisclosed SEC investigation ends, we have some of the records. They show this was a Foreign Corrupt Practices Act (FCPA) investigation involving a Diebold distributor in Saudi Arabia.

What’s notable, and even positive for Diebold, is how fast it ended – only six months after it started.

Records we obtained show it started in Feb-2024 and ended in Nov-2024. Most take much longer. We’ve seen FCPA probes last for 10 years.

Elbit Systems Ltd – ESLT

Removed from Watch List

Undisclosed SEC investigation ends. In Aug-2025, we learned an undisclosed SEC investigation we first found at Elbit Systems on 22-Oct-2024, was over. We know of about 50 pages of related records which we are trying to obtain. Nothing notable in the research history here.

Disclosure Insight research provides data, commentary, and analysis on public company interactions with investors and with the SEC. Our work is heavily reliant on company disclosures and our expertise in using the Freedom of Information Act.

This report does not constitute investment advice or an offering to buy, sell or recommend any securities. The information herein is distributed purely as a newsworthy event. All information contained herein is derived from publicly available disclosures as made by the companies cited in this report, and/or documents obtained from the U.S. Securities and Exchange Commission.