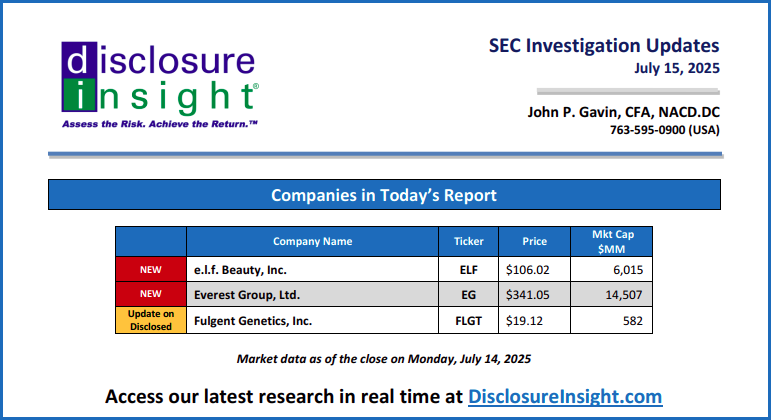

SEC Investigation Updates: July 15, 2025

Updates on SEC investigative activity - Three (3) companies

All-access clients are welcome to contact us anytime to learn more.

Today’s report -

e.l.f. Beauty, Inc. - ELF

Everest Group, Ltd. - EG

Fulgent Genetics, Inc. - FLGT

Click on the PDF here if you prefer a printable version of this report.

COMPANY COMMENTS

e.l.f. Beauty, Inc. – ELF

New Warning. Early signal received on 24-Jan-2025, then confirmed as an ongoing investigation on 24-Apr-2025. First investigation we found since we started covering ELF in Apr-2020. Added to DI Watch List.

Everest Group, Ltd. – EG

New Warning. Abrupt departure of CEO, Jan-2025. Early signal received on 29-Jan-2025, then confirmed as an ongoing SEC investigation on 24-Apr-2025. First SEC investigation we found since we started covering Everest Group in Nov-2012.

From the Everest Group 8-K filed on 08-Jan-2025:

On January 3, 2025, Juan C. Andrade, President and Chief Executive Officer and director of Everest Group, Ltd. (“Everest”) notified Everest that he was resigning to pursue another opportunity. Added to DI Watch List.

Fulgent Genetics, Inc. – FLGT

Update on Disclosed SEC Investigation - SEC investigation ends, but DOJ overhang remains.

Fulgent’s 10-Q filed 02-May-2025, confirms the SEC has closed its probe into 2018–2020 disclosures and lab billing. Our research, dated 22-May-2025, tells us there remain no ongoing exposures.

A preliminary enforcement recommendation from May 2024 was dropped in April 2025, and Fulgent reversed a $1M contingency. Management mentioned the SEC resolution on its earnings call but did not address ongoing DOJ investigations.

As the 10-Q excerpt shows (next page), the DOJ investigation is still active (the SEC investigation is noted in the final paragraph).

While the SEC closure is positive, investors should remain cautious until the DOJ matter is resolved.

As disclosed in the 10-Q, the DOJ’s focus areas include the following –

Medically unnecessary testing

Improper billing practices

Violations of Anti-Kickback and Stark Law

Potential false claims to the COVID Uninsured Program.

Related Civil CIDs target records involving named customers.

In addition, the Health Resources and Services Administration (HRSA) is conducting an audit reviewing ~$549M in COVID test reimbursements from 2020–2022.

From the Fulgent Genetics, Inc. 10-Q filed on 02-May-2025:

As previously disclosed in the Company’s periodic reports filed pursuant to the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Company has received a Civil Investigative Demand, or CID, issued by the U.S. Department of Justice, or the DOJ, pursuant to the False Claims Act related to its investigation of allegations of medically unnecessary laboratory testing, improper billing for laboratory testing, and remuneration received or provided in violation of the Anti-Kickback Statute and the Stark Law. Among other things, this CID requests information and records relating to certain of the Company’s customers named in this CID.

Similar to other laboratories in the industry, the Company has been subject to an audit by the U.S. Health Resources and Services Administration, or HRSA, with respect to its reimbursement for COVID-19 tests furnished to patients believed to be uninsured. The Company recorded approximately $548.9 million of reimbursements from HRSA under the Uninsured Program during the years ended December 31, 2022, 2021, and 2020. There is uncertainty with respect to the methodology HRSA will use in its audit and whether and how HRSA will extrapolate audit results. The Company has provided HRSA’s auditors with requested information in connection with its audit in an effort to resolve any issues related to its audit, including any reimbursed amounts that may need to be returned to HRSA. The Company has also received a CID issued by the DOJ pursuant to the False Claims Act related to the DOJ’s investigation as to whether the Company submitted or caused to be submitted false claims to the Uninsured Program.

The Company is fully cooperating with the DOJ in connection with the CIDs that it has received. The Company cannot currently predict when these CIDs and HRSA audit matters will be resolved, the reasonable or likely outcome of these matters, or their potential impact, which may materially and adversely affect the Company’s business, prospects, and financial condition. These matters are not formal claims, and discussions and investigations remain ongoing. As such, the Company cannot reasonably estimate the loss or range of loss, if any, that may result from any material government investigations, audits, and reviews in which it is currently involved, given the inherent difficulty in predicting regulatory action, fines and penalties, if any, and the various remedies and levels of judicial review available to the Company in the event of an adverse finding. As a result, the Company has not recorded any liability related to these CIDs or audit matters.

In addition, and as previously disclosed, the SEC was conducting a non-public formal investigation, which related to (i) the matters raised in the requests for the CID regarding allegations of medically unnecessary laboratory testing, improper billing for laboratory testing, and remuneration received or provided in violation of the Anti-Kickback Statute and the Stark Law and (ii) the Company’s Exchange Act reports filed for 2018 through 2020.

On May 6, 2024, the SEC staff advised the Company that the SEC staff made a preliminary determination to recommend that the SEC file an enforcement action against the Company based on a corporate negligence theory, which, if authorized, would have alleged violations of the Securities and Exchange Act. In April 2025, the SEC advised the Company that it had concluded this investigation, with no enforcement action recommended. The Company previously recorded a $1.0 million potential liability with respect to this matter and is no longer recording any potential liability in connection with this matter.

[Emphasis added]

-- John P. Gavin, CFA, NACD.DC

This report does not constitute investment advice or an offering to buy, sell or recommend any securities. The information herein is distributed purely as a newsworthy event. All information contained herein is derived from publicly-available disclosures as made by the companies cited in this report, and/or documents obtained from the U.S. Securities and Exchange Commission.

Our Terms of Service, relevant disclosures, and other legal notices can be found here.