Carvana Co. – CVNA $345.25 US Mkt Cap: $74.7 B

Summary & Opinion: New Warning. Run fast, run far.

Since it reported in late July, the Street has happily cheered Carvana’s great earnings, while overlooking a recently disclosed SEC subpoena. Not us. We see a dangerous connection between Carvana’s disclosure of an SEC subpoena in the 10-Q filed 30-Jul-2025; a Hindenburg Research warning in Jan-2025; and, the disclosure of an SEC inquiry buried in an 8-K, over five years ago, in Mar-2020. Yes, five years ago.

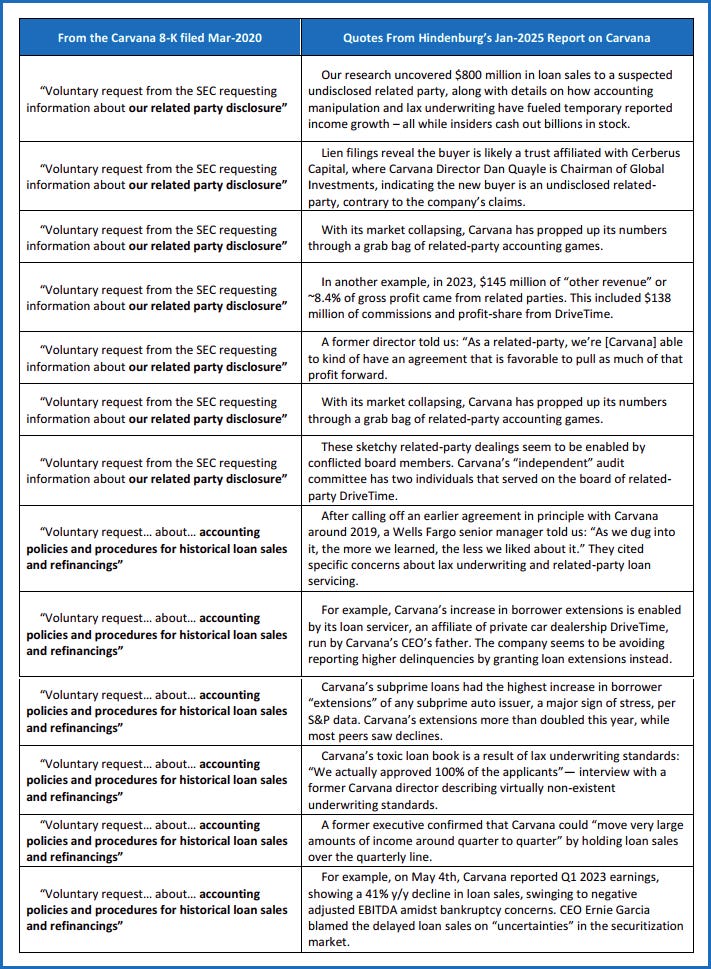

Relevant excerpts from the Mar-2020 8-K, the Jan-2025 Hindenburg Research report, and Carvana’s SEC subpoena disclosure appear later in this report.

In its 10-Q filed 30-Jul-2025, Carvana largely attributes its SEC subpoena to a report by, “a now-defunct short-selling firm,” that published a warning on the company in Jan-2025. Anyone following Carvana knows it was Hindenburg Research that published a warning on Carvana in Jan-2025. This is consistent with our work which found the SEC often opened investigations into companies that appeared in Hindenburg’s reports in the past, usually within 30 days of publication.

The Hindenburg report was published on 02-Jan-2025. Carvana said it “voluntarily contacted” the SEC about it, presumably, shortly thereafter. A related SEC subpoena wasn’t disclosed until 30-Jul-2025, many months later. In our experience these disclosure delays often mean something changed, and usually not for the better.

Carvana has a long history of keeping ongoing SEC investigative activity from investors.

Even absent any connection to a disclosure made in Mar-2020, just the fact Carvana is telling you about any SEC subpoena now is itself meaningful. First, that Mar-2020 disclosure was never repeated or updated at any time over the past five years. Next, we repeatedly found active SEC investigative activity at Carvana, last confirmed as ongoing in Apr-2025. Yet we found no clear disclosures of SEC investigative activity at Carvana since Mar-2020.

Carvana’s Added Risk With the Trump SEC

Even if Carvana’s newly-disclosed SEC subpoena is solely the result of Hindenburg’s Jan-2025 warning, as the company wants us to believe, that alone is quite bad for the company. Why? Trump’s back in the White House.

Under the Trump 2.0 SEC, the threshold for an SEC investigation to become formal is now much higher than it was in the past. Keep in mind, subpoenas are only issued in formal SEC investigations.

If Carvana’s newly-disclosed SEC subpoena is solely the result of Hindenburg’s Jan-2025 warning, that tells us the company’s SEC investigation met that heightened standard. That has terrible implications for investors.

Before we move on, keep in mind that anything that came up as a result of that 2020 SEC investigation could easily factor into any investigation of Carvana today.

DI’s Findings

Early Signal of a possible SEC investigation first found at Carvana in Oct-2020. Since then, an active and ongoing SEC investigation has been confirmed repeatedly, most recently in Apr-2025.

DI’s Take

Again, we think that newly-disclosed subpoena is merely the latest in a long-running SEC investigation of Carvana. The easiest way to find out is to just ask the company these few questions:

You never gave us an update on that SEC inquiry you disclosed back in Mar-2020. Whatever came of that?

When was your first contact with the SEC on the investigation you disclosed in your Jul-2025 10-Q?

Have there been other subpoenas? If so, how many and when?

Carvana’s March 2020 “Stealth” Disclosure of an Informal SEC investigation

Early in the covid pandemic, on 30-Mar-2020, Carvana filed an 8-K, ostensibly to give investors a “Current Update on the Business.” Tucked within this same 8-K, Carvana said this –

In addition, we have received a voluntary request from the SEC requesting information about our related party disclosure and accounting policies and procedures for historical loan sales and refinancings. We are providing relevant documentation in response to this request.

Nowhere in the above disclosure excerpt are words one would expect, such as inquiry, investigation, probe, informal, formal, or subpoena.

This disclosure sounds routine, harmless even. It’s not. This represents the stealth disclosure of an SEC investigation, in this case, an informal SEC inquiry.

Carvana’s July 2025 Disclosure of an SEC Subpoena -

From the Carvana Co 10-Q filed on 30-Jul-2025

In January 2025, a now-defunct short-selling firm published a report including inaccurate, incomplete, and otherwise misleading information about us. We engaged outside legal counsel to independently evaluate the allegations, and voluntarily contacted the U.S. Securities and Exchange Commission (“SEC”). Based upon that evaluation and our own review, we reaffirmed our conclusion that the allegations raised in the short-seller’s report were inaccurate, incomplete, and misleading. In June 2025, we received a subpoena from the SEC requesting information that we believe primarily relates to the allegations raised by the report. We are fully cooperating with the SEC Staff.

Notable Events

Mar-2020: Carvana makes what we called at the time a “stealth disclosure” of an SEC inquiry buried within an 8-K at the time. We detail it below, next page.

Sep-2021: Disclosure Insight, then known as Probes Reporter, issued a warning on Carvana in Sep-2021, at $330/share. This went on to become one of our best calls, as the stock fell to about $5 by Dec-2022. Our full Sep-2021 warning is worth your time. It’s posted with this report.

Comparing Carvana’s March 2020 8-K

to Hindenburg’s January 2025 Allegations

Addendum: Disclosure Insight/Probes Reporter September 21, 2021 Warning on Carvana -

This report does not constitute investment advice or an offering to buy, sell or recommend any securities. The information herein is distributed purely as a newsworthy event. All information contained herein is derived from publicly-available disclosures as made by the companies cited in this report, and/or documents obtained from the U.S. Securities and Exchange Commission.

Neither John Gavin nor Disclosure Insight holds any positions or ownership interests in the companies cited in today’s report.

Our Terms of Service, relevant disclosures, and other legal notices can be found here.