Data Shows Far Fewer SEC Investigations Since Inauguration Day

Project 2025 Has Landed Hard at the SEC

From John’s Desk …

“The SEC has increasingly expanded its jurisdiction beyond its statutory mission of investor protection, using enforcement and rulemaking to pursue political objectives. A conservative administration should refocus the Commission on fraud prevention and disclosure, not social policy.”

- Project 2025, Mandate for Leadership: The Conservative Promise (Heritage Foundation, 2023)

The FOIA Data are Undeniable

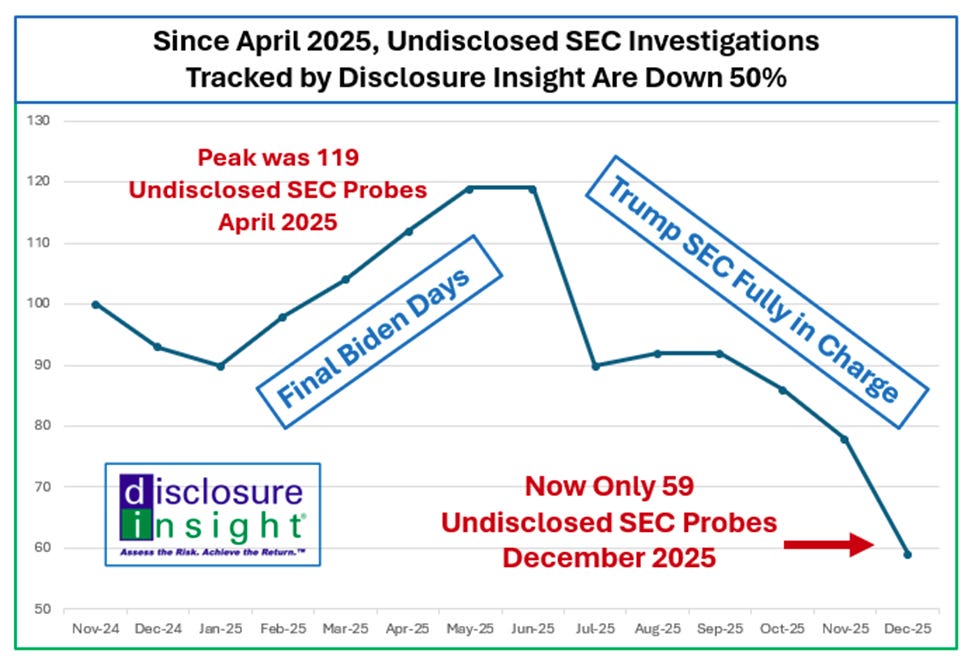

Disclosure Insight is now tracking 50% fewer undisclosed SEC investigations than was the case early in the new Trump 47 administration.

The above chart shows just how fast this new Trump SEC has been closing its ongoing SEC investigations. From a peak of 119 in April, as of December we are down to only 59 companies with undisclosed SEC investigations recently confirmed as ongoing.

For comparison, in November 2020, we were only tracking 64 undisclosed SEC investigations. This was near the end of the Trump 45 administration.

Yet here in December 2025, it’s still relatively early in Trump 47. Our process and volume of FOIA requests have not changed. The results have. Expect this number to continue to fall.

In future updates I will brief you on where those investigations have closed and what it means for SEC enforcement priorities going forward.

The Value of DI Watch List is Even Greater Now

In a bit of an unexpected twist, the DI Watch List is now more valuable to your work than under the Biden administration. Let me explain.

With far fewer undisclosed SEC investigations today than was the case just seven months ago, those that remain likely carry far higher risk then we might have perceived when the data set was twice its current size.

For example, our work found that many of the companies that disclosed cyber intrusions were investigated. That seemed a bit much, but that’s how it was. Barring something unusual, investors rightly do not care much about an SEC investigation into a disclosed cyber intrusion.

Most of those cyber investigations are now closed, or in the process of closing. Taking companies like that off the Watch List helped remove low-signal noise from the list.

The Data has Started Coming In … It is Troubling

Finally, the trends I am seeing regarding the regulatory and enforcement priorities of this administration are both troubling and something you will want to know about.

Here are some I will speak to in future pieces:

Reduced/changed areas of SEC focus that are likely to hurt investors.

Troubling trends already showing up in SEC comment letters.

Foreign Corrupt Practices Act investigations.

Changes involving whistleblower activity.

There are also changes I am seeing that are good for both investors and public companies. I will speak to them as well.

That’s it for now.

Drop me a line, would love to know what you think. – John

Brilliant data journalism here. The 50% drop in undisclosed investigations since April is remarkable. What really got me though is the whistleblower angle you teased, because I've seen firsthand how much harder it gets to report potential fraud when there's a percieved lack of follow-through from regulators. Trimming low-signal noise like routine cyber cases makes sense, but if the investigation reductions start signalng that enforcement is just lighter period, that feedback loop could chill legitimate whistleblowing. Looking forward to seeing the whistlebower activity analysis.

As your aware, Carvana was added to the S&P 500 index creating a short term squeeze inflating Carvana’s stock price to $460 per share with the requirement of index funds to buy CVNA stock. As you reported earlier, Carvana is under SEC investigation and the securities fraud litigation is deep in discovery. Depositions are being scheduled and the Garcias lawyers are pulling out all stops to prevent this. My questions for you are - Do you have any updates the SEC investigation is active and do you think the Trump administration’s SEC will negotiate a fine first this type of alleged fraud? The Garcia’s (insiders) continue to sell millions in stocks monthly